In April's politburo meeting, the Chinese government's newfound focus on an oversupplied housing market was setting the stage to usher in new rescue policies to stabilize the economy. Weeks later, Bloomberg reported that the government was considering a plan for local governments to purchase millions of unsold homes to clear the excess supply.

According to sources familiar with government discussions, the State Council requests feedback from various provinces and government entities on the home-buying plan.

Here's more color on the plan via Bloomberg:

Local state-owned enterprises would be asked to help purchase unsold homes from distressed developers at steep discounts using loans provided by state banks, according to two of the people. Many of the properties would then be converted into affordable housing.

Officials are still debating details of the plan and its feasibility, the people said, adding that it could take months to be finalized if China's leaders decide to go ahead. The housing ministry didn't respond to a request for comment.

In a note earlier, Goldman's Peter Sheren told clients that this news is nothing new and "has been speculated for 3-4 weeks."

"This was one of the initial catalysts for the China Property Sector (GSXACNRE) to rally 21% in the past month," Sheren said.

Housing prices in China have already fallen 25-30% from the peak and presented a dark cloud of economic uncertainty over China's financial system stability and continued risk for China's macroeconomic backdrop. If authorities do proceed with the plan, in a separate note, Goldman's Wang Yi believes "this new initiative might help to stabilize housing prices."

Here's more commentary from Goldamn's Sheren this morning:

"Wang Yi and team think if the coming measures focus on clearing "saleable inventory" (which includes both completed and uncompleted but unsold units, and that are less than 3 years of last year sales volume) or about 1/4 of the entire inventory backlog, property price stabilization might be achievable.

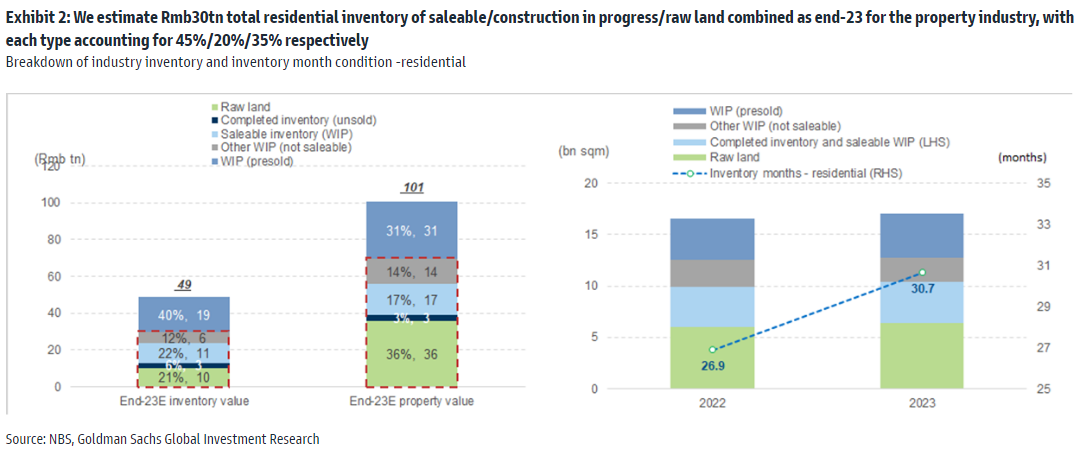

"Wang Yi estimates that there was Rmb30tn (US$4tn) in residential inventory by end-2023. If fully built-up, this will be about 10X what the market sold in 2023, or 1/4 of total housing stock as of end-2023. The required capital investment for completing such inventory could be 5X the construction CAPEX in 2023."

In terms of what's needed in this fiscal bazooka to bottom China's ailing residential housing market, Shujin Chen, head of China financial and property research at Jefferies Financial Group, estimated at least 2 trillion yuan ($277 billion).

Bloomberg Economics pointed out that the property sector "is unlikely to stabilize until the gap between housing supply and demand closes."

Government data shows that about 3.6 billion square feet of unsold housing inventory linger on the market, the highest level since 2016.

Meanwhile, Tianfeng Securities estimates the new plan could cost 7 trillion yuan to absorb the inventory in 18 months.

One major problem local governments face in reducing the housing surplus is the need to increase debt levels. Banks would also face mounting pressure as rising bad loans and contracting margins have weakened their balance sheets.

From a market perspective, this is terrific news, as the CSI 300 Real Estate Index initially jumped 5% after the report.

However, deep, alarming structural problems persist in the world's second-largest economy.

No comments:

Post a Comment