Authored by Mike Shedlock via MishTalk.com,

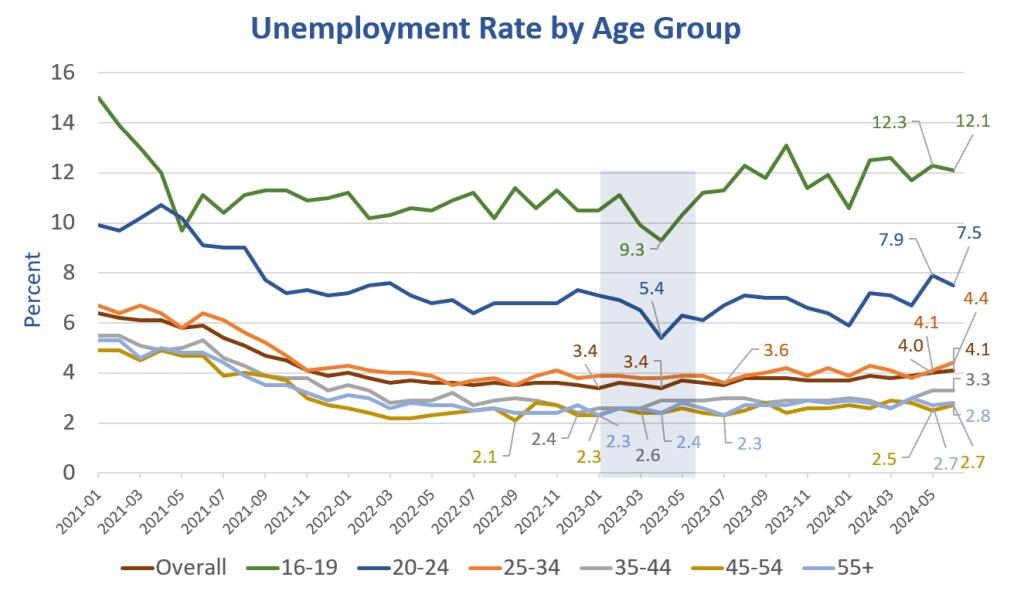

The economy is slowing and that will hit the zoomers first and the hardest, especially renters...

Shaky Ground

The idea for this post comes from the Wall Street Journal article American Borrowers Are on Shakier Ground.

Years of higher inflation and interest rates have left consumers mired in debt, even as overall economy hums.

I dispute the Journal’s statement the “overall economy hums”.

If the economy was humming we would not see charts like I am about to present.

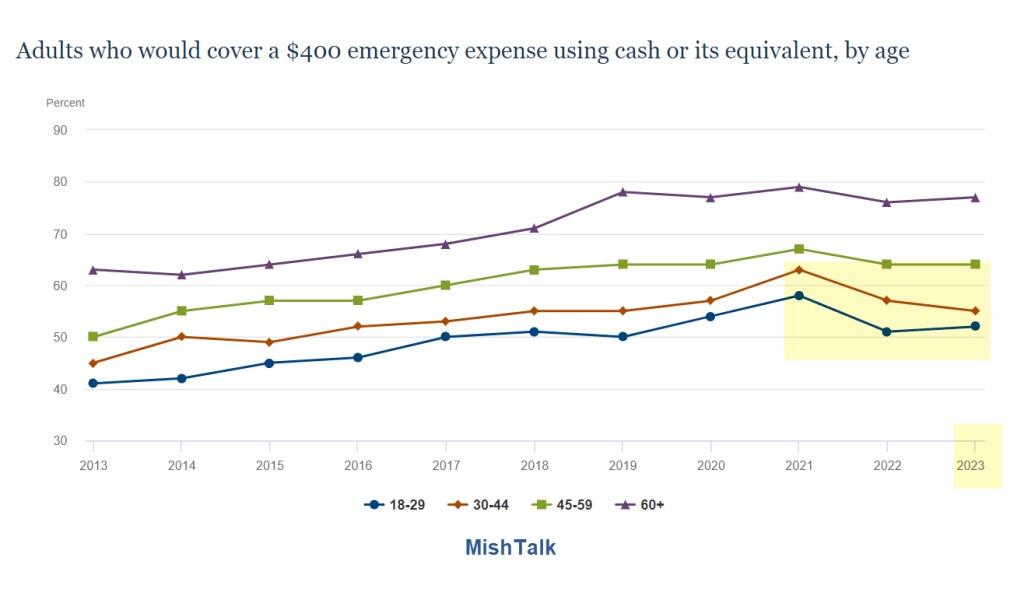

Unexpected Expenses

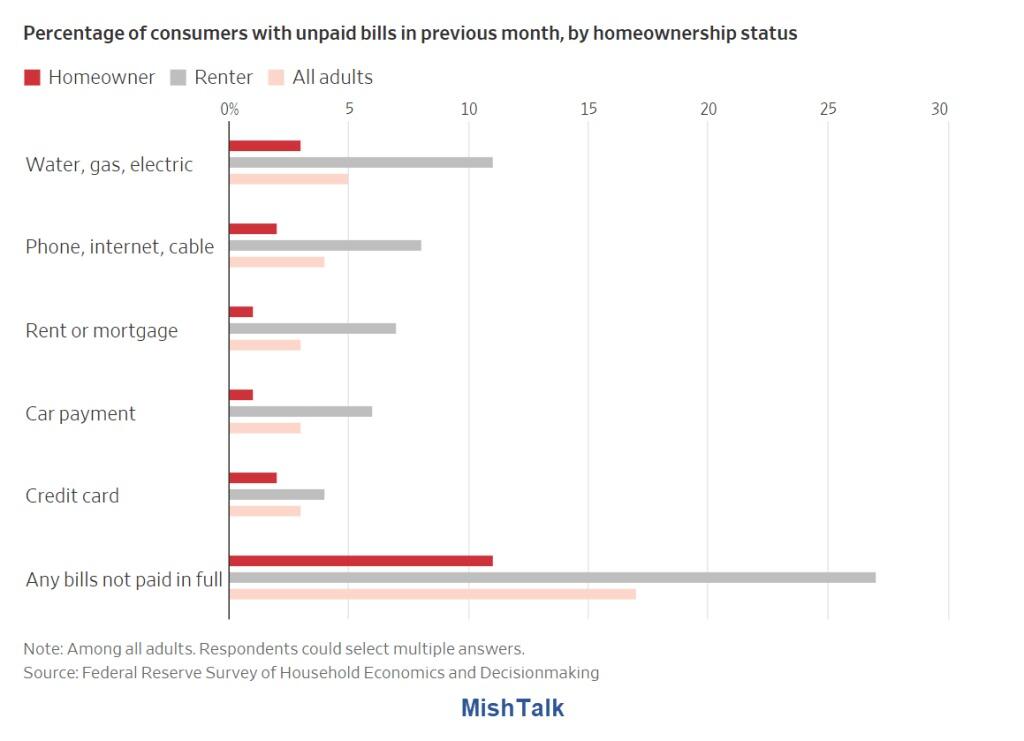

That chart is from the Federal Reserve Report on the Economic Well-Being of U.S. Households

The report was updated May 21, 2024 but it it only through 2023. Zoomers and younger Millennials are in trouble.

Rot Starts at the Periphery

The Wall Street Journal comments Big Banks and Customers Continue to Feel Pressure From Higher Rates

JPMorgan’s second-quarter profit declined 9% year-over-year to $13.1 billion. That figure excludes one-time items, including a $7.9 billion gain on an exchange of the bank’s shares of Visa.

Credit-card loans rose faster than spending at all three banks, a sign that more borrowers carried over balances month to month.

“When you really dig into what’s happening across different consumers, the folks on the lower end of the wealth or income spectrum are struggling more,” Wells Fargo Chief Financial Officer Mike Santomassimo said on a call with reporters.

JPMorgan’s credit-card arm—the biggest in the country—said charge-offs on loans rose by nearly two-thirds from a year earlier. The rise in part reflected a normalization from years of historically low levels, Chief Financial Officer Jeremy Barnum told reporter

JPMorgan CEO Jamie Dimon repeated his view that interest rates could wind up staying higher than some economists have forecast.

“Market valuations and credit spreads seem to reflect a rather benign economic outlook,” he said in prepared remarks. “But there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world.”

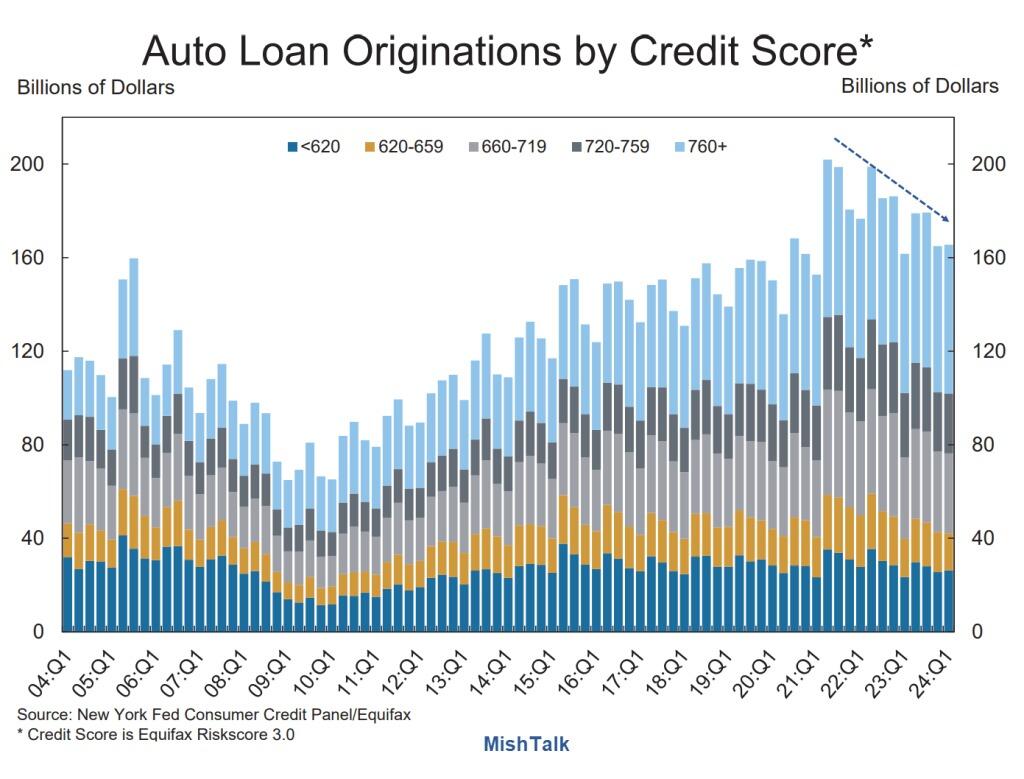

Auto Loans Plunging

The above chart and the next few are from the New York Fed Household Debt and Credit Report for 2024 Q1.

Are auto loans a sign of a humming economy? I think not.

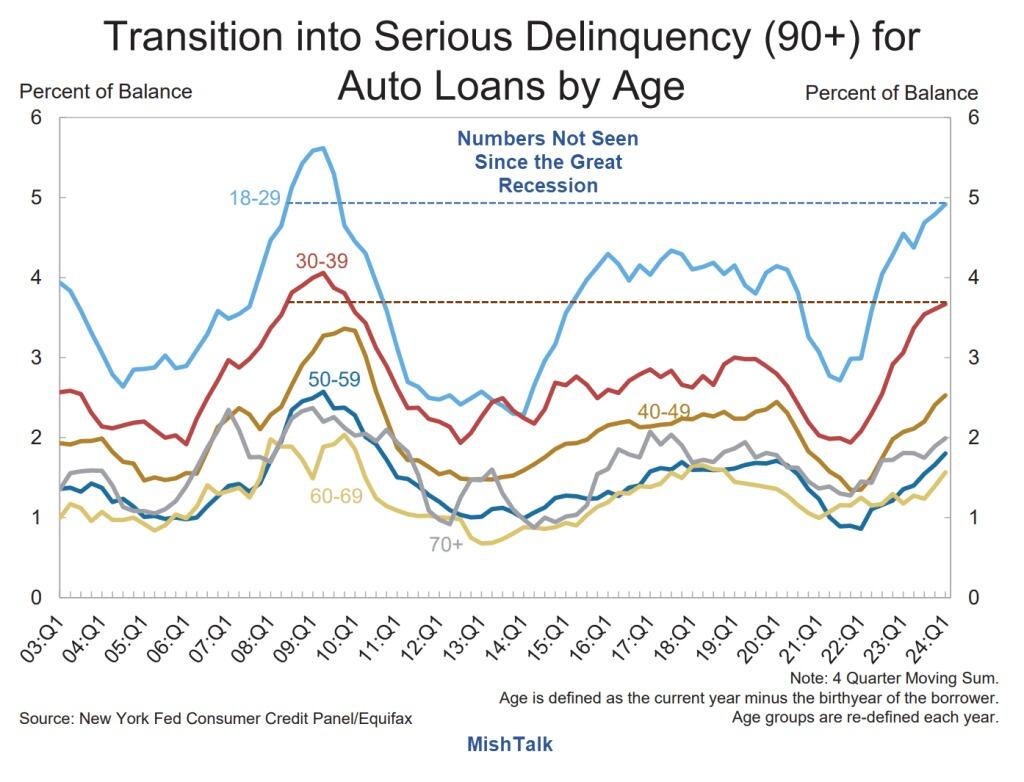

Transition into Serious 90+ Auto New York Fed Quarterly Report

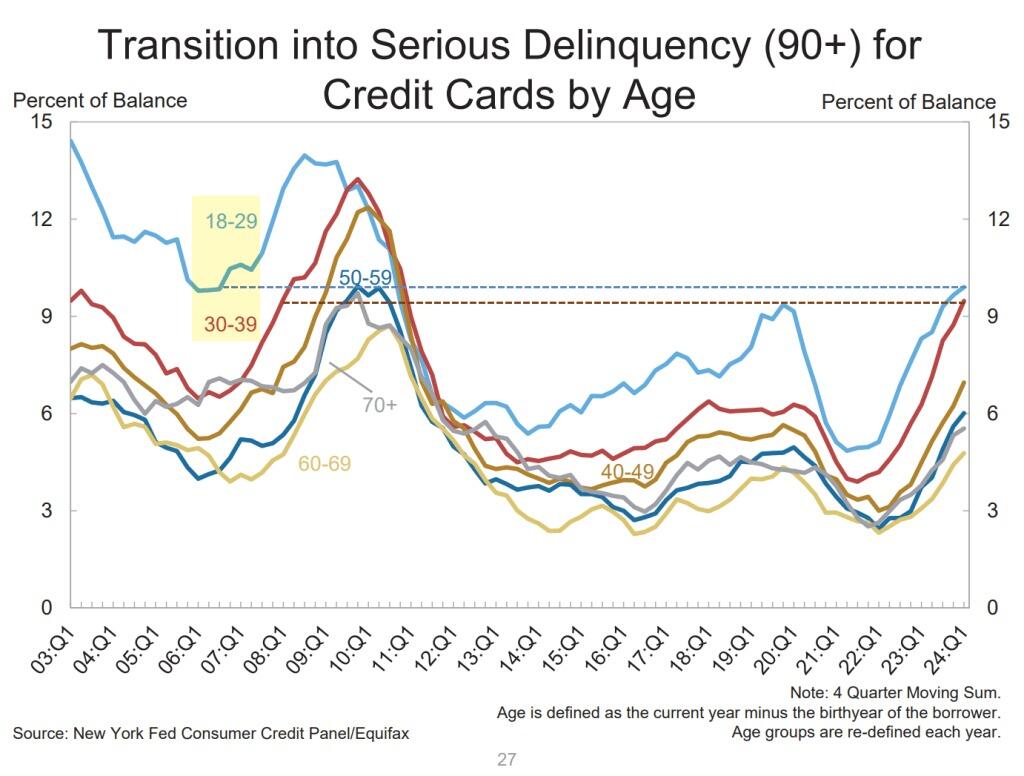

Transition into Serious 90+ Credit Cards New York Fed Quarterly Report

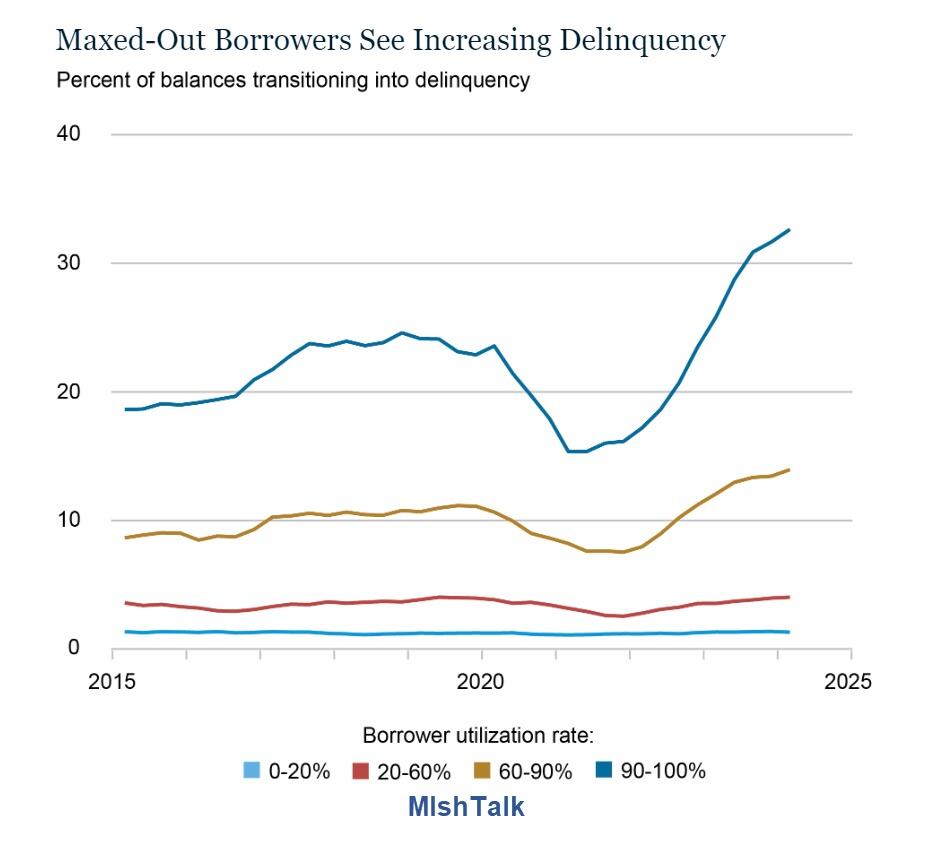

Maxed Out Borrowers

If you have maxed out your credit card there is about a 33 percent chance you are delinquent.

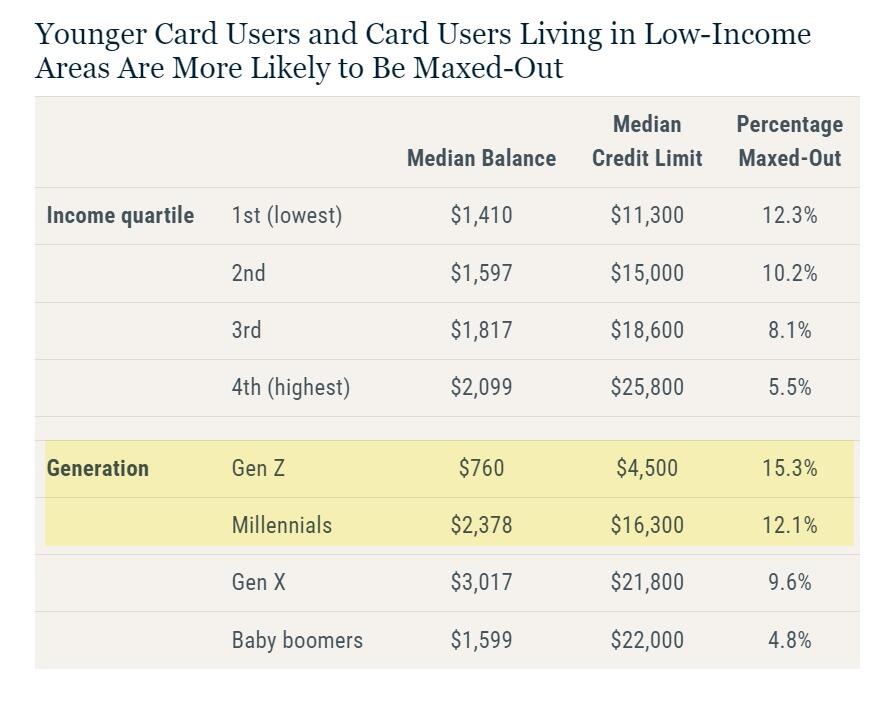

Who might that be?

Maxed Out Credit Card Users

The preceding two charts are from the New York Fed report Delinquency Is Increasingly in the Cards for Maxed‑Out Borrowers

Notably Gen Z has the highest delinquency transition rate, but Millennials were the only group whose delinquency exceeded their pre-pandemic rate.

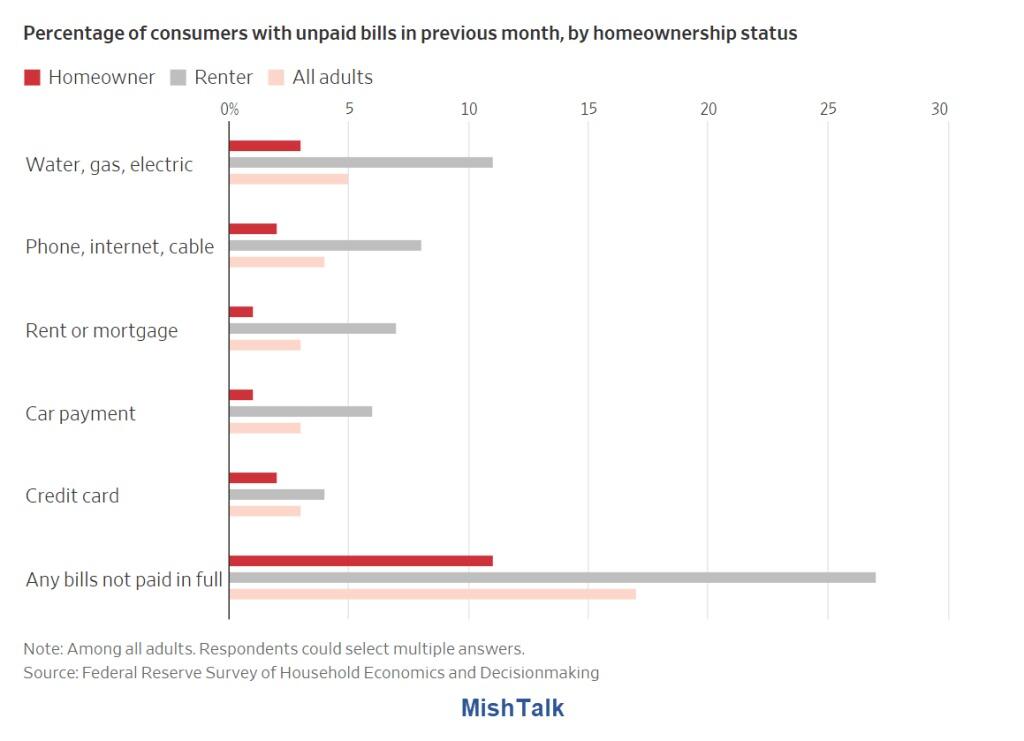

Let’s return to the first chart, repeated for convenience.

Percentage of Consumers with Unpaid Bills by Homeownership Status

Over 25 percent of those who rent have unpaid bills! Over 10 percent have not paid their water, gas, or electric bills.

This isn’t humming. It’s the verge of disaster. And I have been talking about this setup all year.

April 20: People Who Rent Will Decide the 2024 Presidential Election

May 31: Why Consumers Are Angry About the Economy in Five Pictures

June 19: Why Angry Renters Will Decide the Election, Take II

July 5: The Unemployment Rate Bottomed a Year Ago, Who’s Impacted the Most?

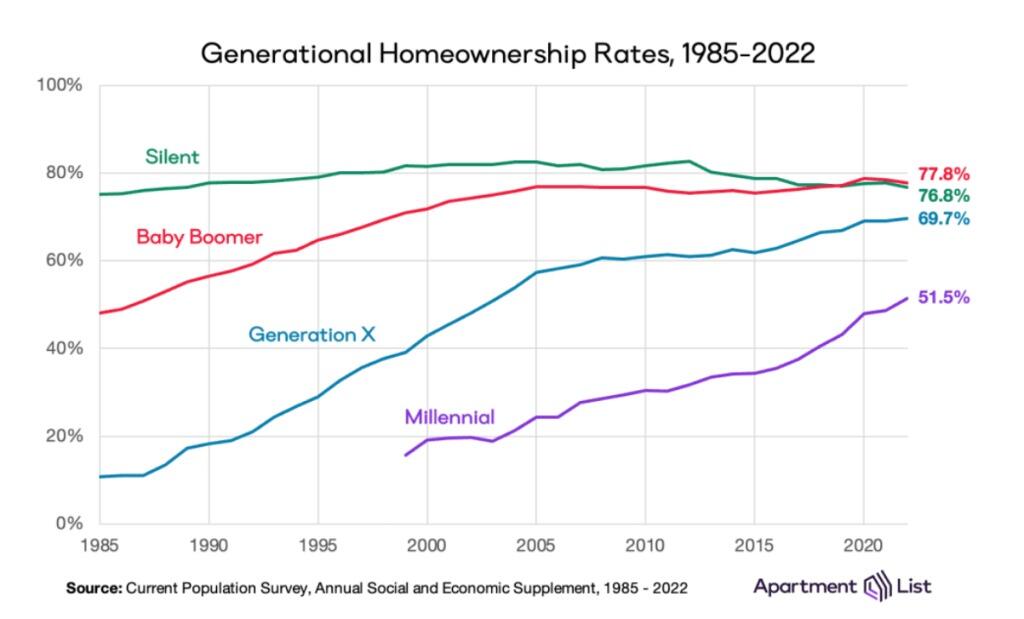

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

The Fed does not see this freight train coming even though it is standing in the middle or the track facing the oncoming train. This is despite nearly all of the charts in this post are from Fed reports.

And most economists are as blind as the Fed.

Unemployment Rate by Age Group

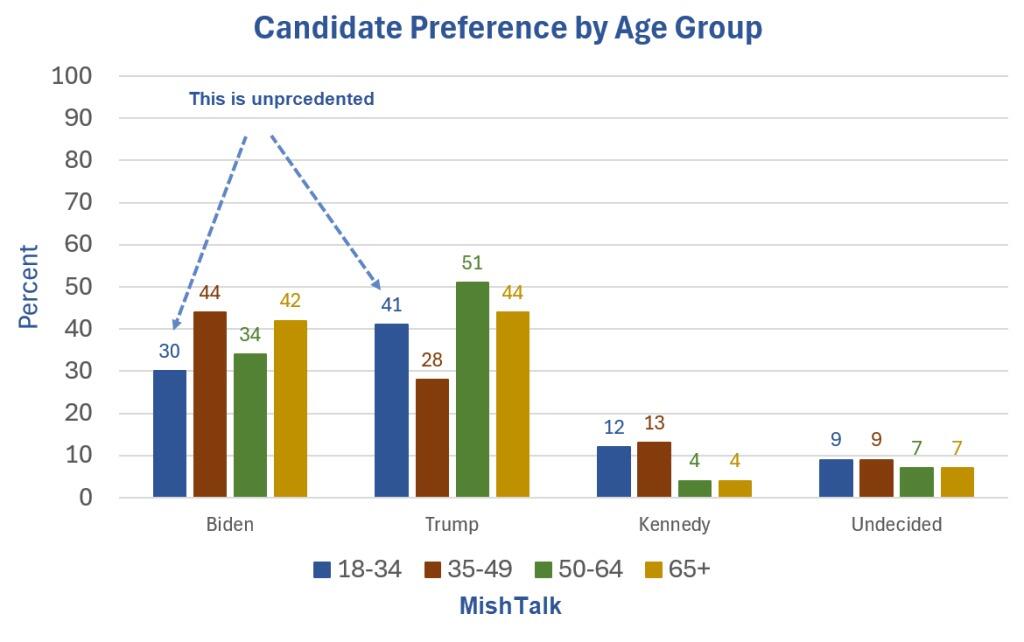

Candidate Preference by Age Group

An amazing 41 percent of those 18-34 are for Trump with only 30 percent for Biden.

That’s an unprecedented 11 percentage point gap for Republicans. In 2020 this age group voted overwhelmingly for Biden.

I discussed the above poll and also candidate preference by race in Post-Debate USA Today-Suffolk Poll Has Grim News for President Biden

Please click on link for 11 charts.

So who are the renters that will decide the election?

Zoomers, millennials, and black renters. They are priced out of a home while watching rent go up at least 0.4 percent every month for 33 months. That string finally snapped in June with a 0.3 percent rise.

Biden Seeks Rent Controls

On July 17, I noted Biden Seeks Supreme Court Term Limits, Medical Debt Cancellation, Rent Controls

Sorry Joe, it’s too late. You are gone and a recession has started, not that rent controls had a chance. They are a terrible idea anyway, but desperation set in.

A recession coupled with a weakening economy for the next three months is hard to overcome, especially given Kamala’s political baggage.

On July 8, I commented Weak Data Says a Recession Has Already Started, Let’s Now Discuss When

Since then, more weak data hit the fan.

I tie the economic picture together in Three Top Reasons Mortgage Delinquencies Are Rising

Rot starts at the periphery then spreads to the core. Panic is coming.

No comments:

Post a Comment