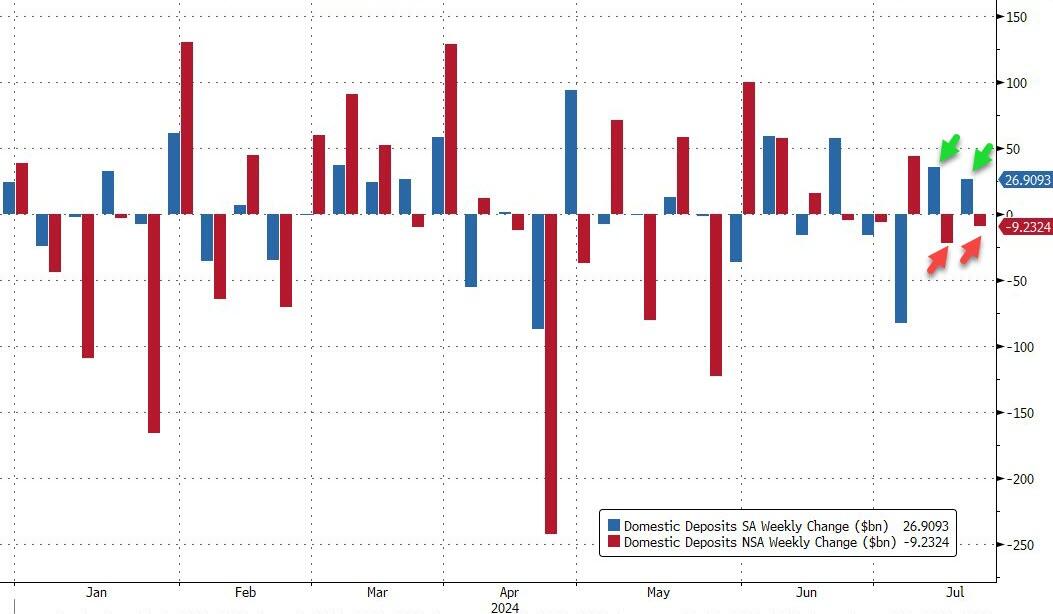

The last two weeks have seen US bank total deposits rise by $33BN (on a seasonally-adjusted basis)...

Source: Bloomberg

But.. on a non-seasonally-adjusted basis, total US bank deposits have fallen $40BN...

Source: Bloomberg

Which makes us ask again - what exactly is a 'seasonally-adjusted bank deposit'?

But we will move on from that farce.

Excluding foreign deposits, the picture gets even more malarkey-ful - a $9BN unadjusted deposit outflow is magically morphed into a $27BN inflow by The Fed's fuckery.

The unadjusted outflow was all from large banks while the adjusted deposits showed strong inflows into both large and small banks (+$19BN and +$8BN respectively).

Source: Bloomberg

That's $31BN of (unadjusted) deposit outflows magically morphed into $62BN of deposit inflows in the last two weeks...

Doe it even matter anymore?

via zer0hedge

No comments:

Post a Comment