Endgame: Interest On US Debt Surpasses $1 Trillion For First Time Ever, Exploding August Budget Deficit To Record High

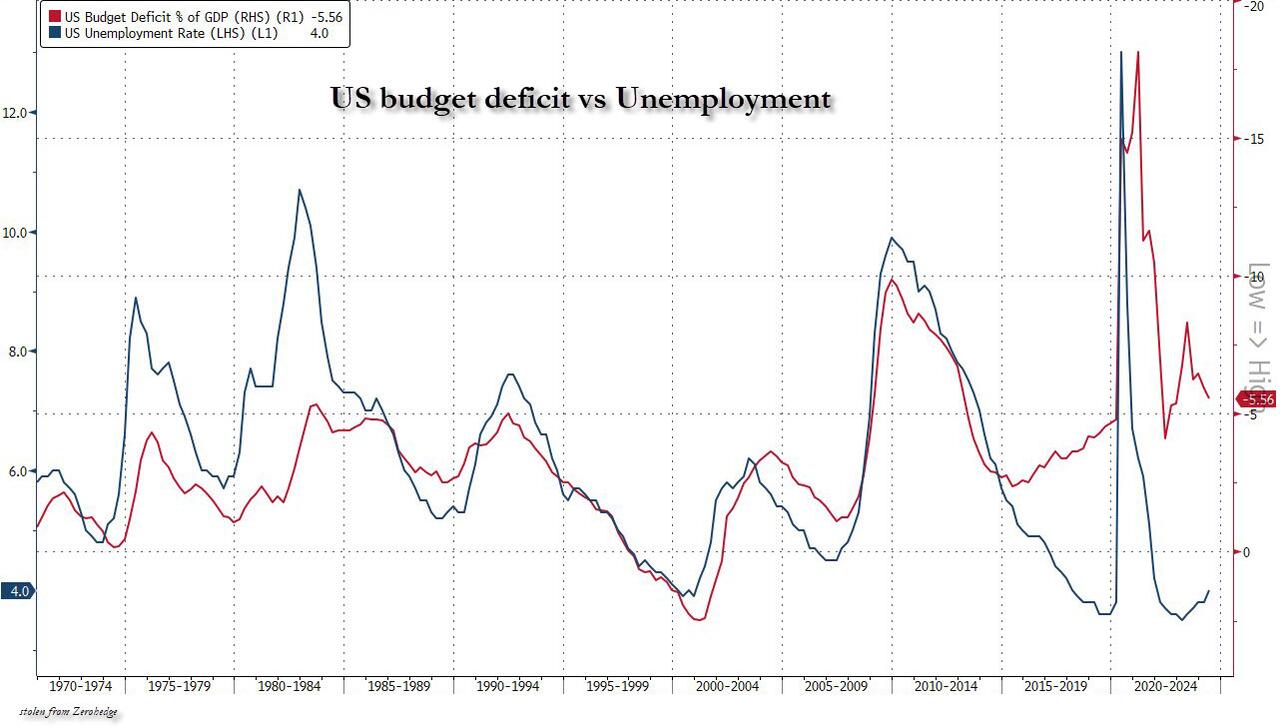

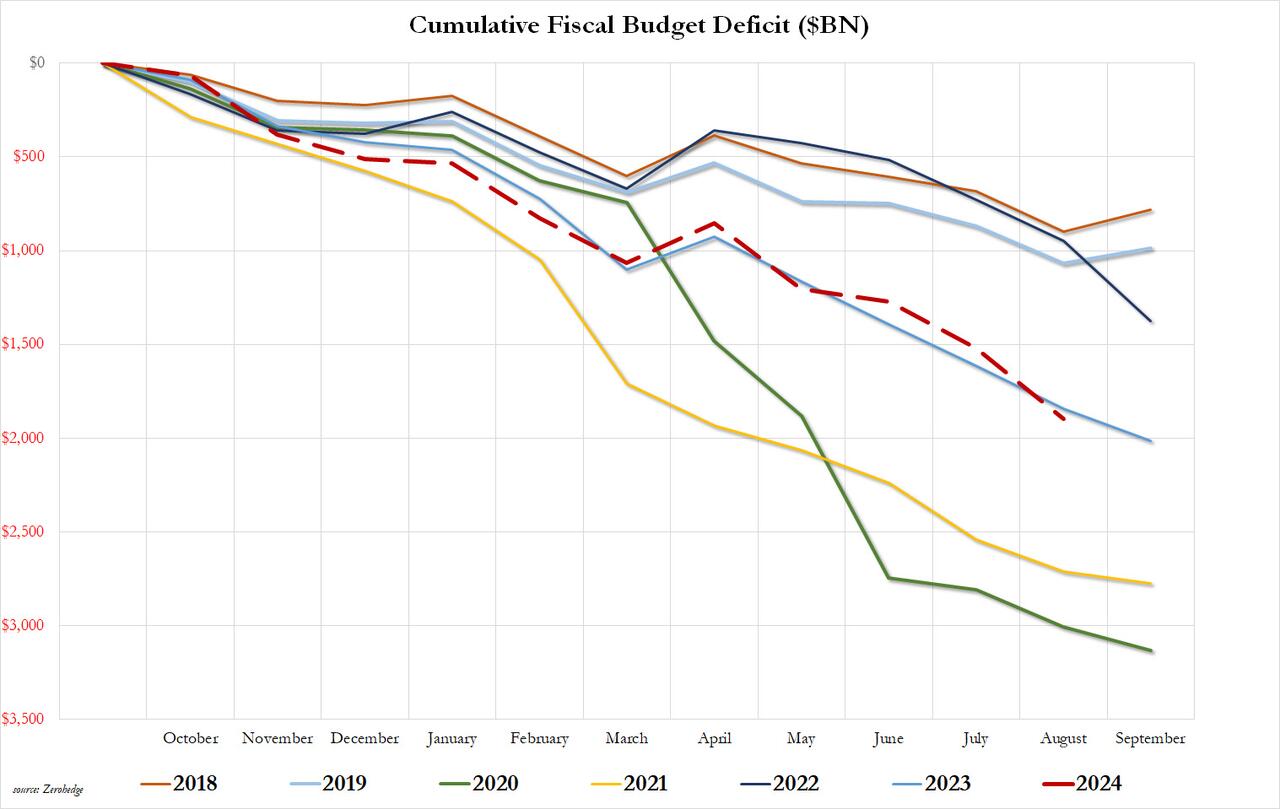

2024 was the year when the runaway US budget deficit was supposed to gradually normalize, and after two crisis-years, the US was supposed to end its drunken sailor spending ways. And for a while there, it seemed touch and go, with the cumulative US deficit initially overtaking 2023 - forget about the batshit insane 2021 and 2022 when the deficit hit a mindboglilng 18% of GDP...

... before slowly easing back for a few months, only to sprint ahead of 2023 once more in August...

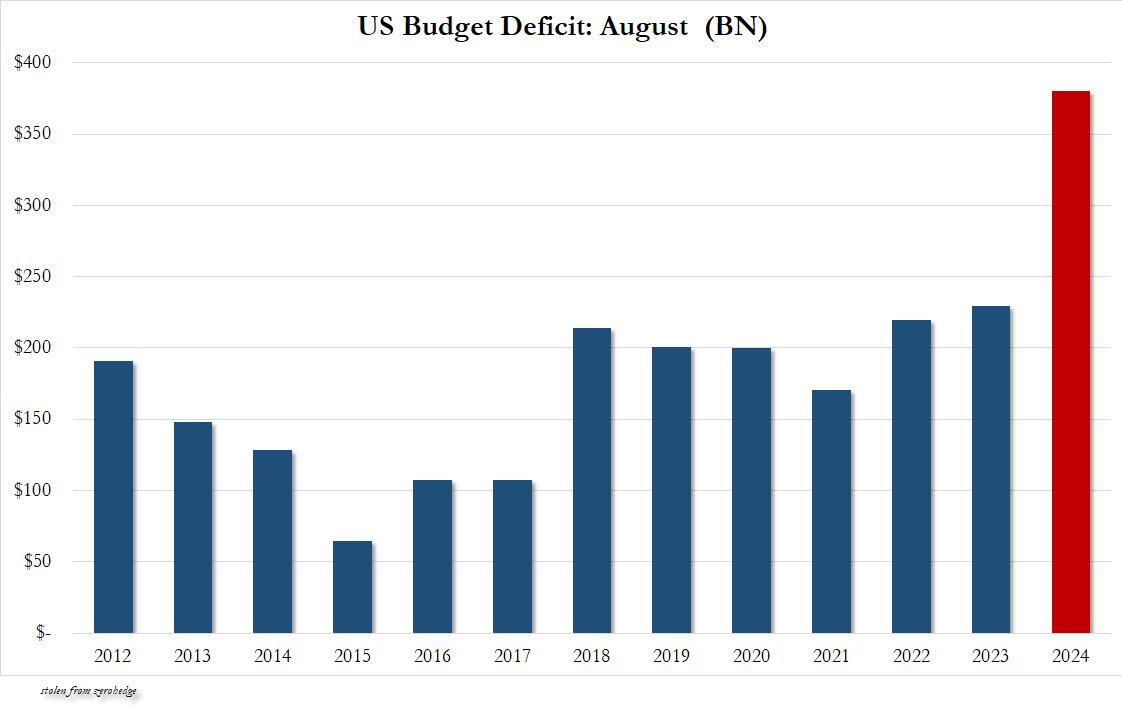

... when THIS happened: an August budget deficit of a staggering $380 billion, up more than 50% from the $243 billion in July, and up more than 55% from July, and up 66% from last August... oh, and almost $100 billion more than the median estimate of $292.5 billion, which may be why the Treasury quietly snuck the number out by leaking it after 5am ET when everyone was sleeping, not at its regular time of 2pm ET.

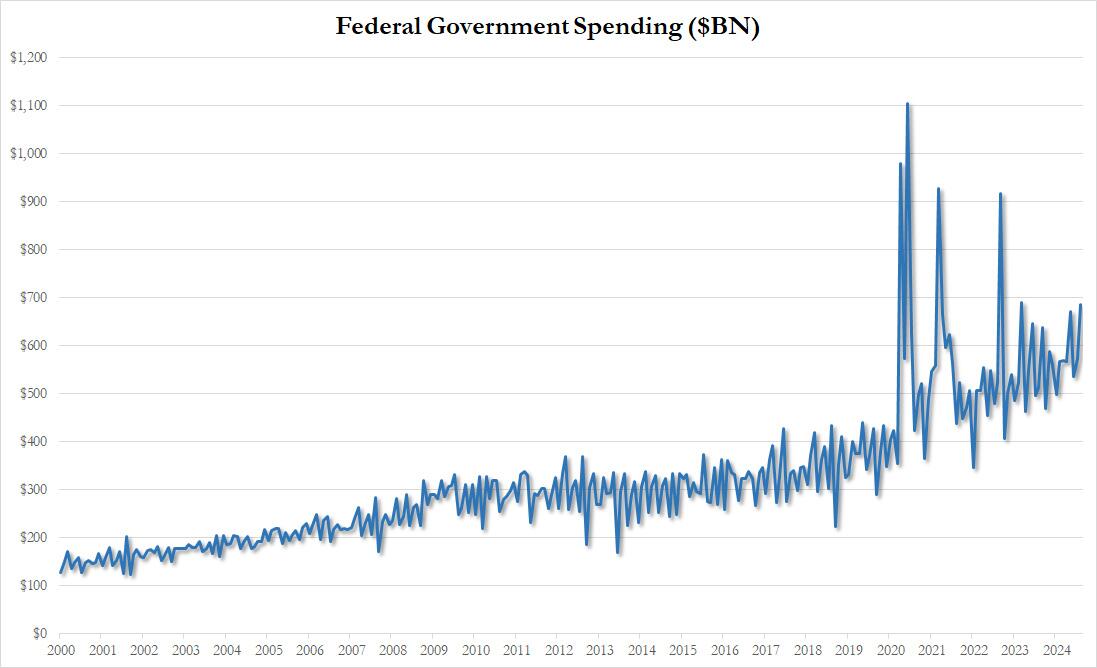

That's right, in a year when the monthly budget deficit was meandering along in the merry Chernobyl way, not great, not terrible, someone in the BIden admin had the brilliant idea to spend a metric asston of money to reboot the economy so we don't get a recession just in time for the elections, and sure enough, government spending went into absolutely epic overdrive, as outlays hit a mindblowing $686 billion, the highest since March 2023, and only a handful of crisis months during the covid crash saw greater government spending in any given month.

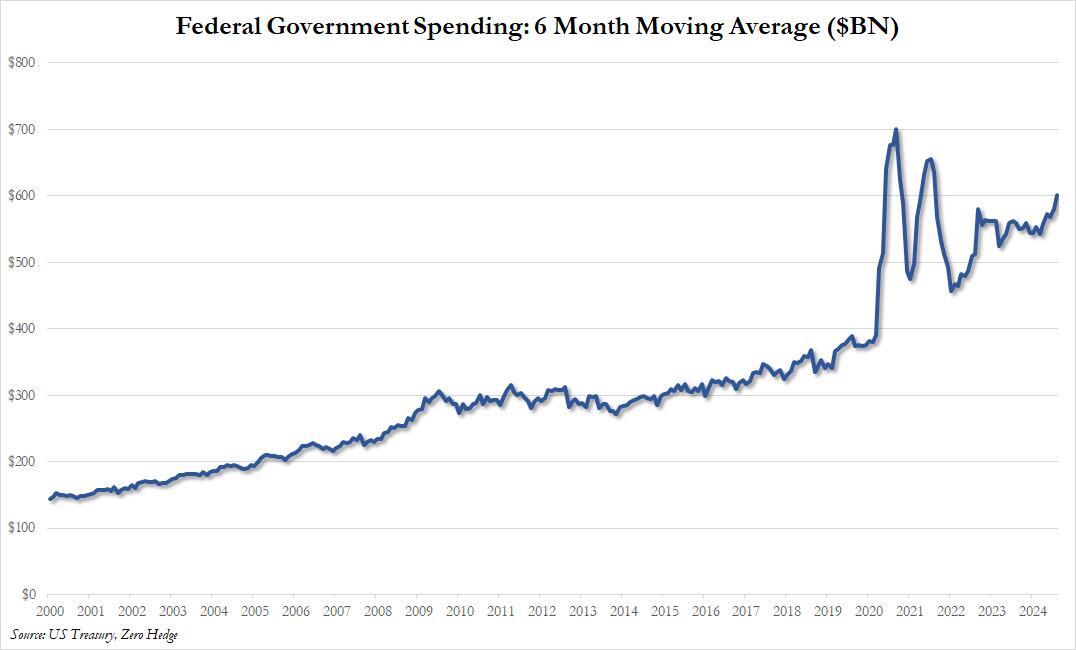

Here is another way to show the data: smoothing out for outlier months, by presenting the 6 month moving average: well, it just hit the highest... since covid!

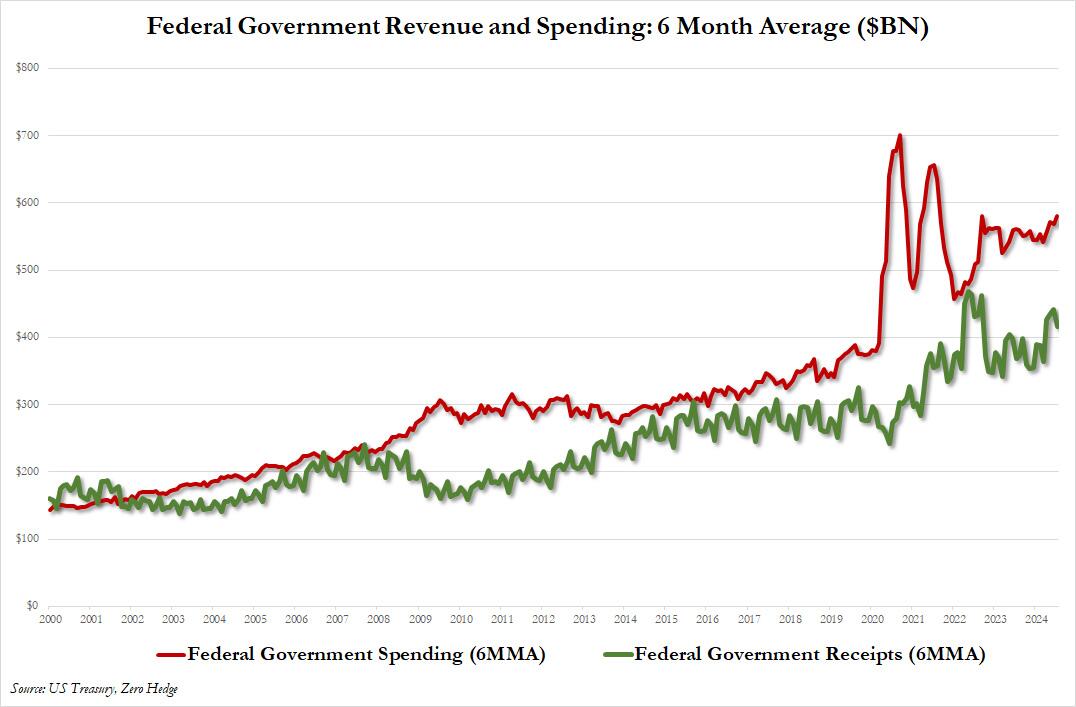

For those wondering how government receipts have performed during this period of exploding spending, here is the answer:

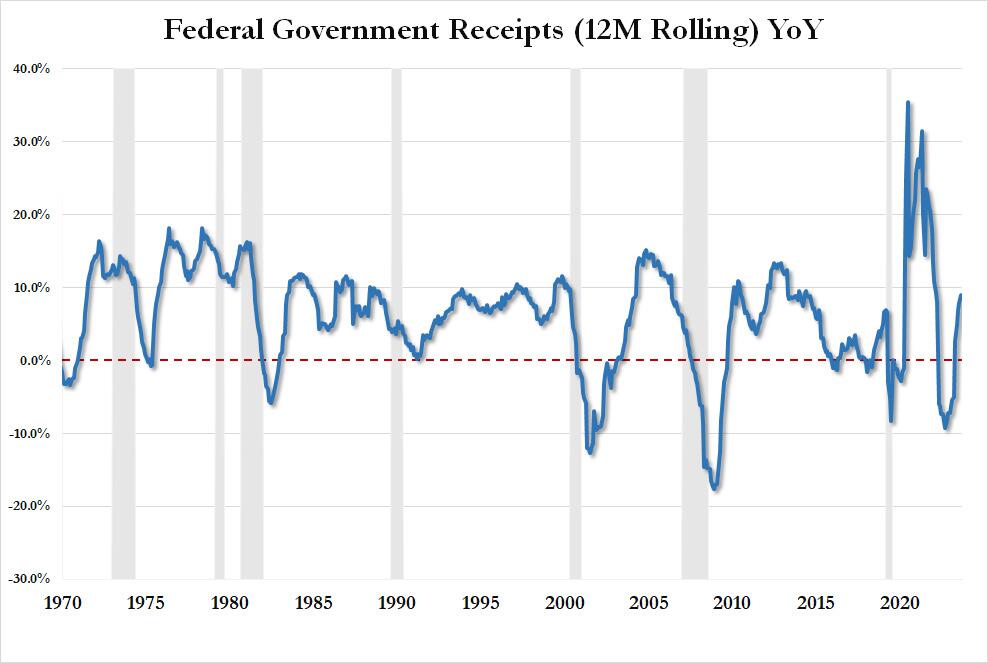

... which is remarkable because while spending is absolutely exploding, revenues have also managed to bounce back, largely thanks to capital gains taxes on the surging stock market.

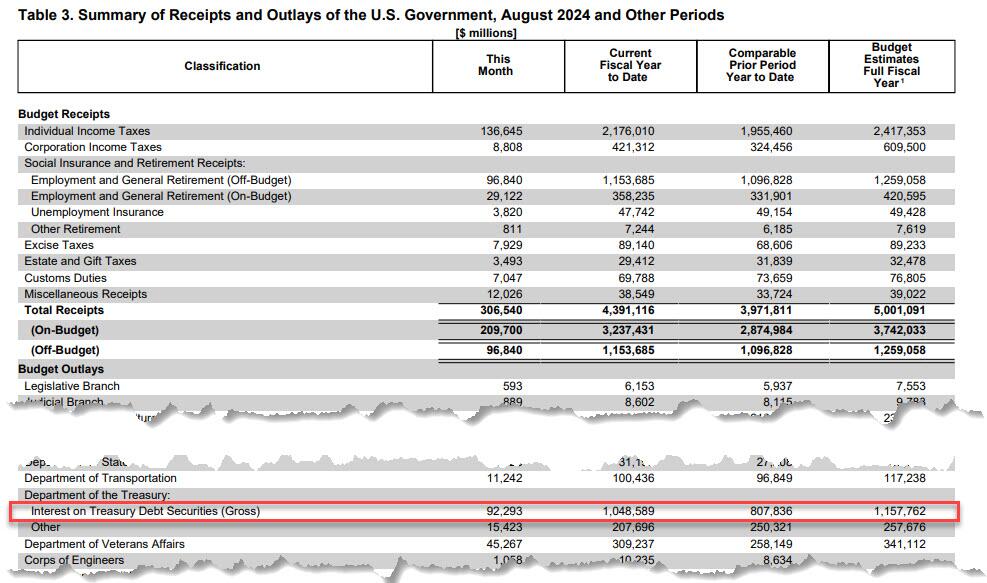

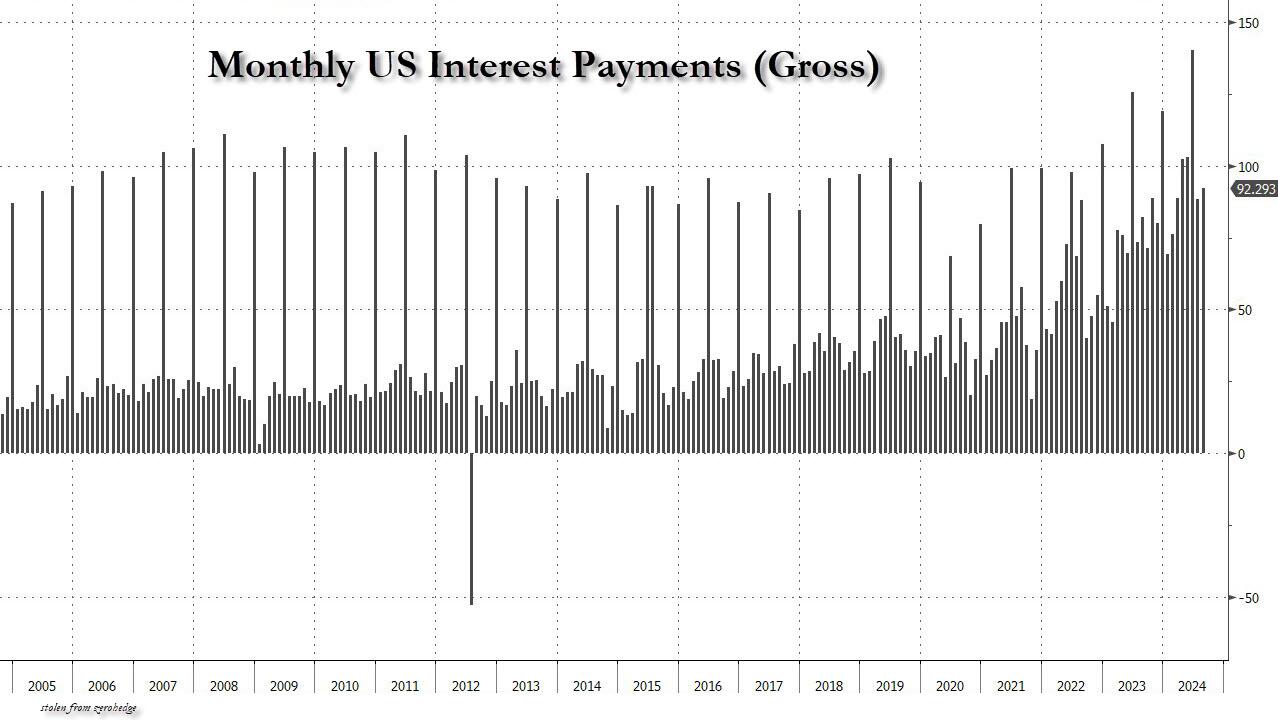

Yet looking at the dire big picture, it is unfortunately all downhill from here for one simple reason: we have now crossed the Minsky Moment in terms of how much the US spends on interest on its debt, which as regular readers know is hitting a new record high every day - it just closed above $35.3 trillion - and is growing by about $1 trillion every 100 days. That means that with interest rates at 40 year highs, the prediction we made last July, has finally come true because according to today's Budget statement, the amount spent on gross interest in August was $92.3 billion...

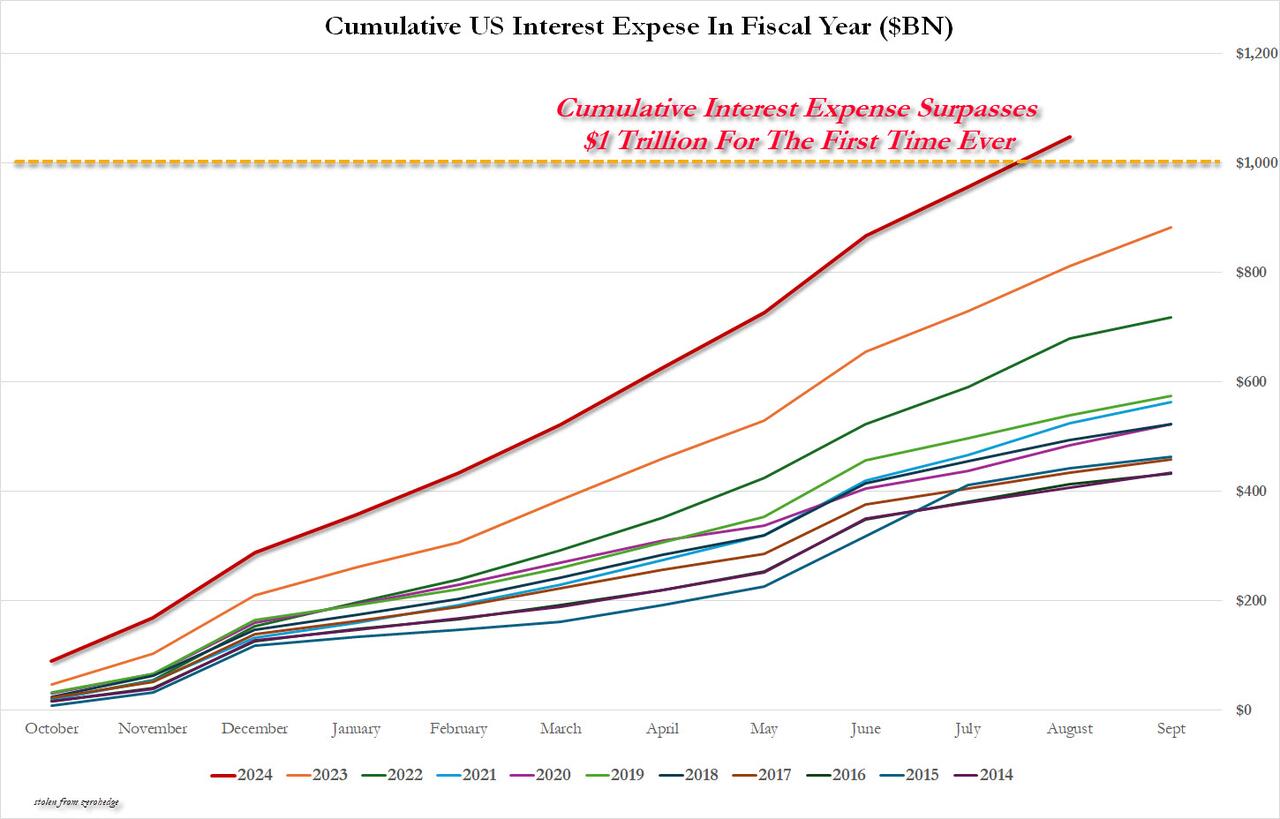

... which means that the cumulative total for Fiscal 2024 - where there is one more month to go until the end of the fiscal year (which ends Sept 30) - just hit an all time high of $1.049 trillion, the first time in history when interest on US debt has surpassed $1 trillion.

And what's worse, this number is not even annualized (as explained, it's just for 11 months of the year): annualized, US debt comes out to $1.158 trillion, or $1.2 trillion rounded up as the Treasury Department itself admits...

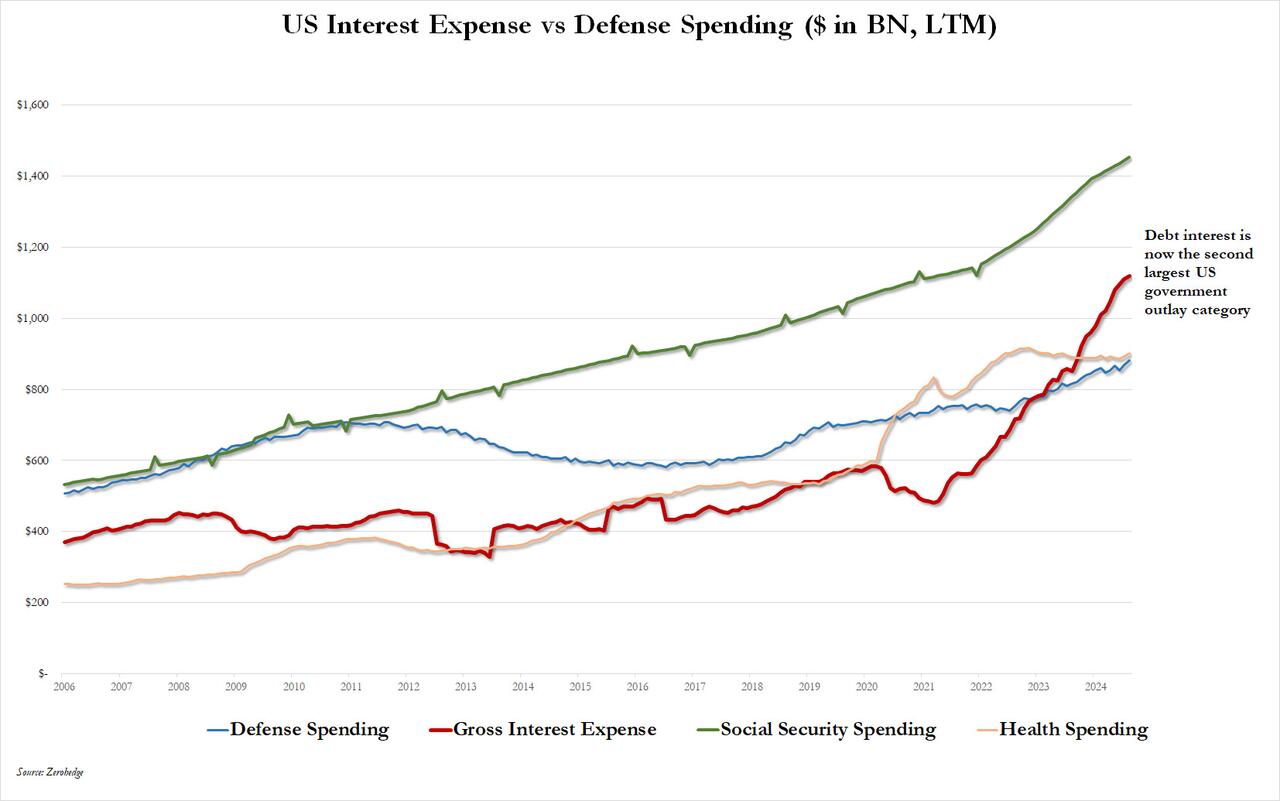

... and the stunning punchline is that as of today, gross interest on US debt has surpassed not just Defense spending, but also Income Security, Health, Veterans Benefits and Medicare, and is now the second biggest outlay of the US government, second only to Social Security, which is roughly $1.5 trillion annualized.

But wait, there's more: the latest numbers confirm that we are well on our way to hitting our other forecast from April 1, of the US hitting an insane $1.6 trillion in interest expense by the year-end...

... which mean interest expense will soon surpass Social Security spending and become the single largest outlay of the US government, some time in late 2024 or early 2025 at the earliest.

In other words, game over.

Which begs the question: why would Trump even want to be in charge when the house of cards finally comes crashing down. Let Kamala have it...

No comments:

Post a Comment