Why Property Tax Is Illegal

Submitted by Mitch Vexler, President G.P. of Mockingbird Properties

“I sincerely believe that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale” - Thomas Jefferson, 1816

“They who can give up essential Liberty to obtain a little temporary Safety, deserve neither Liberty nor Safety” - Benjamin Franklin

Issue #1

One can argue the 16th Amendment going back to 1913 and we are prepared to do so. The quantified evidence that we have assembled over several years of lawsuits points to exactly why the law as originally written prohibits taxation on unrealized gains. “Market value” as created by the States from which an Assessed Taxable Value is denoted, is in fact an unrealized gain.

Although perhaps well intentioned in its debut, property tax has been made illegal because there are no longer any enforced laws protecting the rights of the real estate taxpaying Citizens.

Let us hold the following to be true:

There are 3,143 Counties in the United States and the vast majority of them under State Law require Uniform Standards of Professional Appraisal Practice (USPAP) and Mass Appraisal Standards.

USPAP is rendered meaningless as it is not followed in favor of hand overwriting property values outside the confines of any law or proper appraisal method.

An Implicit guarantee, as claimed by the Taxing Entities (for example, School District Bonds), for which there is no signature, is not implicit.

Contracts made under duress are unenforceable; "voluntary consent" requires adequate information, lack of coercion, force, manipulation, or intimidation, and the freedom to revoke consent at any time.

If Fraud is discovered, contracts are void.

States and Central Appraisal Districts across the U.S. have violated USPAP, which in many States is a 3rd degree felony for those who signed an Oath of Office.

States and Central Appraisal Districts across the U.S. have violated Mass Appraisal Standards (USPAP Standards 5 & 6).

Many school districts refuse to make public their bond schedules, balance sheet with proper notes, and a sources and uses schedule of the bond proceeds. We have discovered a compound cumulative effect of not retiring the bond debt but rolling it out and rolling the interest rate up.

States and Central Appraisal Districts have violated State Property Tax Codes, for example, in Texas sections 23.01(b) & 23.01(e) to identify a few. (not all inclusive)

States, Taxing Entities (school districts, cities, counties, special districts, etc.), Central Appraisal Districts across the U.S. have violated State Constitutions – Uniform and Equal (Texas) – Board of Equalization in California.

Real Estate Taxpayers (Single Family, Multifamily, Commercial, Land Owners) have had their rights to due process under the 5th and 14th Amendments violated as the recourse to prohibit the equity stripping and theft of taxpayer money has been rendered impossible by the intentional layering of gauntlets such as the Appraisal Review Panels which are comprised mostly of senior citizens who know nothing about appraisal law (USPAP and property tax code) or math.

“Pay your taxes or we will take your house” (We have testimony & audio evidence.)

“Go get a second job to pay your taxes” (We have testimony & audio evidence.)

“We took 60,000 properties out of the database, manipulated them in excel and put them back” Chief Appraiser, Denton Central Appraisal District, County Texas. (We have this recording.)

We calculated that in the last 5 years, roughly $21.2 Trillion of fraudulent property valuation (roughly double in the last 5 years alone) has been created, which resulted in roughly $450 Billion in over taxation paid by Mom and Pop in 2024.

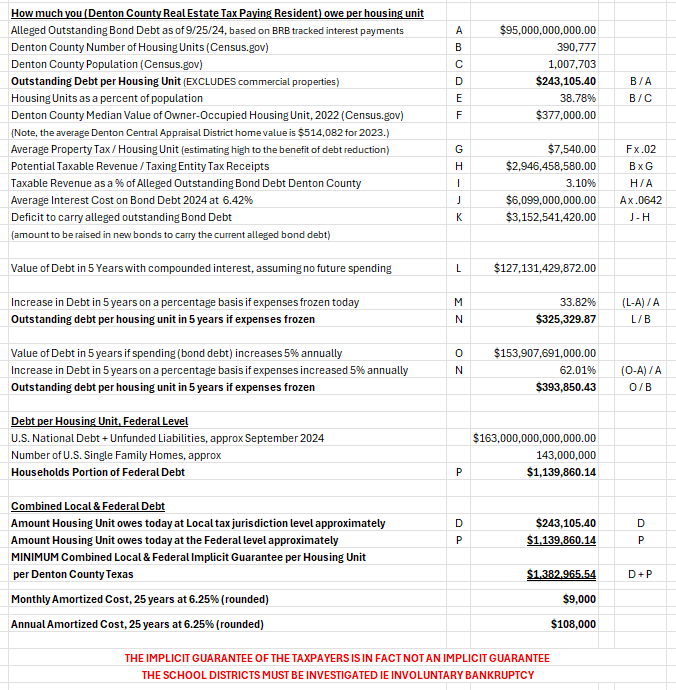

As seen in the graphic below, each homeowner in the U.S. owes roughly $1.3 million of U.S. National Debt, Unfunded Liabilities plus Local Taxing Entity Debt, which if amortized over 25 years at 6.25% would require that your income increase by $9,000 per month immediately which is not possible to pay off. (wording)

The above violates the U.S. Constitution 1st, 5th, 14th, and 16th Amendments.

The above equates to State and Federal RICO crimes throughout the majority of States.

The U.S. Constitution trumps State Law under the Supremacy Clause which exists to prohibit a State from violating its own Constitution.

If property valuation were true, requiring a willing buyer and willing seller neither under duress, and cash settled, then the maximum value assigned could only be what the house was built for or what the house was purchased for, until such time as the house is sold.

The laws and violations thereof have morphed to the point where the cash grab of the local Taxing Entities (i.e. School Districts) have rendered meaningless all the protections in law that were established to protect the Citizen real estate taxpayers, and this has an extreme fraudulent inflation factor. There are 8 elements of real estate tax in the milk that goes in your cappuccino. Therefore real estate tax fraud on a mass scale effects every person who shops whether they realize it or not. The more elements of tax, the higher the inflation, the higher the fraud.

If those protections are going to be ignored (USPAP, State Property Tax Code, State Constitutions and U.S. Constitution), then the net result is the equity stripping of property taxpayers, such that if there is no law, then why pay real estate taxes. In other words, either the law exists, or it doesn’t. Equity Stripping is the compound cumulative effect of paying a fraudulently created overvaluation resulting in over taxation and this means that making money on the purchase of your home has a very low probability of success because the Taxing Entities took your profit by over taxation via the fraud.

If those protections under the law are going to be adhered to, then those responsible for violating the laws must be held accountable. The Taxing Entities (i.e. School Districts) are hiding the bond schedules from the public, which would show that the bonds are not being paid off and that the cumulative compounding of debt and interest is occurring. Many school districts will need to be put into involuntary bankruptcy to unwind what debt can be unwound. We have discovered that there are roughly 143,000,000 single family homes in the U.S. which are burdened by roughly $240,000 of school bond debt.

Either the law exists, your Honor, or it doesn’t. Please state the obvious which is that the law exists, for the protection of the Citizens, and if not, which has clearly been proven, or we would not be in front of the Appellate Court, then eliminating property taxes in favor of a Uniform States Sales Tax (estimate approximately 15.6%) must be implemented to ensure the protections of the Citizens. Return the balance sheet to Mom and Pop, restore transparency by eliminating the real estate tax fraud, and make the playing field fair for all real estate taxpayers and reduce the fraudulently created inflation simultaneously.

Issue #2

Several well-known people on YouTube interviewed me and in one of those videos I asked... “Mr. Spencer (Chief Appraiser Denton County/Central Appraisal District), what is to stop you or any Chief Appraiser from raising the values in 2025 to infinity?” Given that the values are irrefutably created by hand outside any requirements in USPAP, Mass Appraisal Standards, State Property Tax Code, State Constitution and U.S. Constitution, the answer would be nothing. We now have further proof of such a criminal position, which is the November 22, 2024 article that exposes the Montgomery County Assessor in Central Illinois wherein an attempted theft of an approximate 1,400% increase in real estate taxes for 2025 was on the table. To be crystal clear, real estate valuation that adheres to the law is based on quantified analysis of true comparisons, not meeting pre-determined budgets handed to the Chief Appraisers by the Taxing Entities, where many of those Taxing Entities are bankrupt. So, to keep the illusion going is just burning money and is not going to the benefit of students (lower test scores, lower enrollment, closing schools) but rather intended to protect the pensions. It is a form of a second social security.

Are the homeowners responsible for the actions of the School District? NO!

Real Estate Taxpayers have been dupped by omission. When bonds are raised by the school districts, big money is spent in advertising to pull the wool over the eyes of the trusting public, to the point where now roughly 30% of the households will go bankrupt or lose the roof over their head, because of the cash grab at the hands of the Central Appraisal Districts and their owners, the Taxing Entities (i.e. school districts).

Even when ordered by the State Attorney General to turn over the Bond Schedule, we have yet to see a single bond schedule, balance sheet with proper notes, and a sources and uses, which is what should be required as part of the process of raising bond money. The appropriate solution, for this intentional omission and pattern and practice to deceive, is to file the School Districts into involuntary bankruptcy and then sue each person who signed an Oath and hold the attorneys responsible (officers of the court) for violating taxpayers’ rights under both Federal and State Constitutions, as well as pressing criminal charges and disbarment. The main point being… put the school districts into bankruptcy. At the State level the equity stripping of Mom and Pop has now herein been laid bare.

If you think the above is bad, but wait, there is more!

Who purchased the school bonds? Could it be 401Ks and Pensions? Who owns the 401Ks and Pensions? Mom and Pop. What due diligence was done by the purchasers of the school bonds to determine the true value and value at risk?

A school district in Texas with an alleged balance sheet of $8 million has effectively bankrolled the private development of two 2,000-acre solar fields, via 313 Agreements promoted by the State Comptroller. Are the taxpayers obligated to pay for this fraud on the public, where there is no guaranteed return on investment or guaranteed return of investment? NO!

Did the real estate taxpaying citizens agree to fund the non-reduction of bond debt which is intentionally hidden from the public such that even the State of Texas does not know how much debt is being retired but does know that six to twelve billion is being raised every six months? NO!

These problems are not just Texas specific but are across the vast majority of the U.S. because USPAP (the law) is being ignored in favor of unfettered theft of taxpayer money.

Issue #3 – Average Annual Housing Expenses vs Debt (Federal and Local Taxing Entities)

The U.S. Bureau of Labor Statistics reports that the average annual household expenditures were $77,280 (or $6640/month) in 2023, with the largest share going toward housing costs, with property taxes being a significant portion of the cost of housing. Others have crunched the numbers and have shown that for a family of four the average monthly expenditures are between $8450 and $9817, or $101,400 to $117,804 annually.

So, if the average household needs to earn between $77,280 to $117,804 annually to cover a monthly living cost between $6640 and $9817, how can households also cover an additional $9000/month or $108,000 per year in “implicit debt guarantees” resulting from the excessive debt existing at the Local & Federal levels.

The household median income for 2023 was reported at $80,610 by census.gov. So clearly, if their cost of living was $77,280 as stated by the USLBS, they are not saving much (maybe $3000 a year), nor can they cover the implicit debt guarantee of $9000 PER MONTH.

The chart below shows the math behind the $9000 per month of the Local and Federal debt burden, implicit guarantee, using Denton County Texas households as the example population group.

Issue #4

The 16th Amendment to the U.S. Constitution does not provide for, nor state, that all land is owned by the Federal Government. In fact, the war of 1812 was fought to prohibit this exact action. Real Estate Property Owners have been relegated to paying rent on the dirt below their asset, and yet there is no agreed to ground lease with any State government as the Lessor and a property owner as the Lessee. Can anyone show you or me where the Taxing Entities are the ground Lessor in any Taxing County in the United States such as the Lands of His Majesty King Kamehameha III in Hawaii which date back to 1848? NO!

Given the above and given the testimony from across the U.S. that is coming to our office daily, it is clear that Mom and Pop are being taxed out of their homes. What was once the balance sheet of Mom and Pop being a home with a declining debt balance to eventually zero, is no longer possible, making retirement for many impossible. The current situation, including a Military Veteran in Ohio, named Bob, who is 85 years old, on fixed income who bought his home for $24,000, is now being commanded to pay $3,100 in property tax which is money he does not have. What is the benefit to moving this man to senior care that he does not need or want on the dime of the real estate taxpayer at an approximate cost of $80,000 per year?? We have quantified that roughly 72% of the single-family homeowners cannot afford what the Central Appraisal Districts claim as the median value of a home which proves the fraud on its face. The system has become so irretrievably corrupt, that the only solution is the elimination of property taxes in favor of a Uniform States Sales Tax. The balance sheet of home ownership (Mom and Pop being the economic engine of the U.S.) must be reinstated so that when the property is sold, a potential profit is achievable for purposes of retirement and not to force people out of their homes (MF and Single Family) because they can’t afford the fraudulent induced real estate taxes. If not, the system of fraud has effectively bankrupted the vast majority of its Citizens as well as the Taxing Entities (by their own hand) such that the debt on the Federal and or Local level cannot be paid off. It is time to put those responsible in jail. The District Attorneys need to do their job and if they don’t, they are part of the problem. State and Federal RICO laws are clear, and the map is the list I provided at the beginning of this discussion. The evidence is at www.mockingbirdproperties.com/dcad.

What can Mom and Pop do right now to help themselves? Travis Spencer wrote a FREE Course available at https://real-estate-mindset-homebuying-101.teachable.com/ to explain how to create true property comparisons to be used at an Appraisal Review Board meeting.

In addition to the webpage at www.mockingbirdproperties.com/dcad, we have a full library behind the wall designed for attorneys and accountants wishing to dig into the filings, articles and math models. Please email me for the password.

Resources to understand the depth of the problem:

- https://irp.cdn-website.com/39439f83/files/uploaded/Partial_List_of_Violations_Reviewed-052224.pdf

- Jeremy Bagott, MAI, AI-GRS, https://mailchi.mp/2a23230963ef/jeremy-bagott

- Real Estate Mindset, Travis Spencer, https://www.youtube.com/playlist?list=PLo3dZB8Cn9QuemgK3OwUL1qncSqqlfXl_

- George Gammon of Rebel Capitalist with his attorney Robert Barnes, https://www.youtube.com/watch?v=RZK2a8e9gqA

- Dr. Chris Martenson of Peak Prosperity, https://www.youtube.com/watch?v=6lCQqGgGMPk

- Robert Helms, Uncovering Evidence of Massive Fraud, https://realestateguysradio.com/podcast-uncovering-evidence-of-massive-fraud-in-property-tax-valuations/

- Michael Bordenaro https://www.youtube.com/watch?v=uy3vsw30yYw

- Melody Wright https://www.youtube.com/watch?v=MnuIG-7onR8

- JD McCleod KW (series), https://www.youtube.com/playlist?list=PLCYOjMnViaEWx-L1TWl45keK7yK-Gb_Zj

- Luke Smith with Market Mania (Canada) https://www.youtube.com/watch?v=4un987al2lw (part 1)

- https://www.youtube.com/watch?v=AMpeeiDH-Yk (part 2)

- Mike Adams with Brighteon, https://www.brighteon.com/4ddf6d1b-75a7-412c-9cd5-ce283da5b5a0

- Travis Spencer, Free Course https://real-estate-mindset-homebuying-101.teachable.com/

- Kate Dalley, December 17, 2024, https://www.katedalleyshow.com/

- U.S. Debt Clock, https://www.usdebtclock.org

- Mitchell Vexler, What is Inflation – Truth vs Omission https://www.youtube.com/watch?v=Y0XsvlT3jp4

- The Evidence https://www.mockingbirdproperties.com/dcad

No comments:

Post a Comment