Silver on Fire: Vol Bid, Skew Explodes, CTAs Chase

Parabolic

Silver is going full parabolic mode. The trend lines are getting steeper and steeper... Note how far down the 50 day is trading.

Source: LSEG Workspace

Well bid vol

Silver volatility is down from "panic" highs, but remains very well bid. The crowd needs to show uspide exposure...

Source: LSEG Workspace

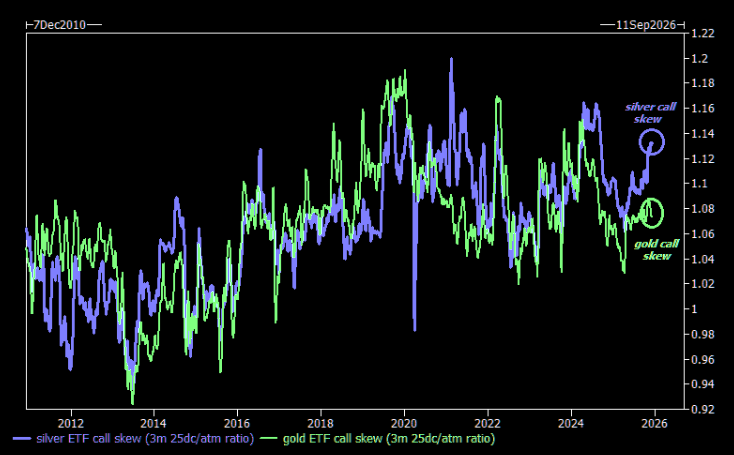

Upside panic

Call skew has exploded to the upside, making gold call skew look "poor"....

Source: GS

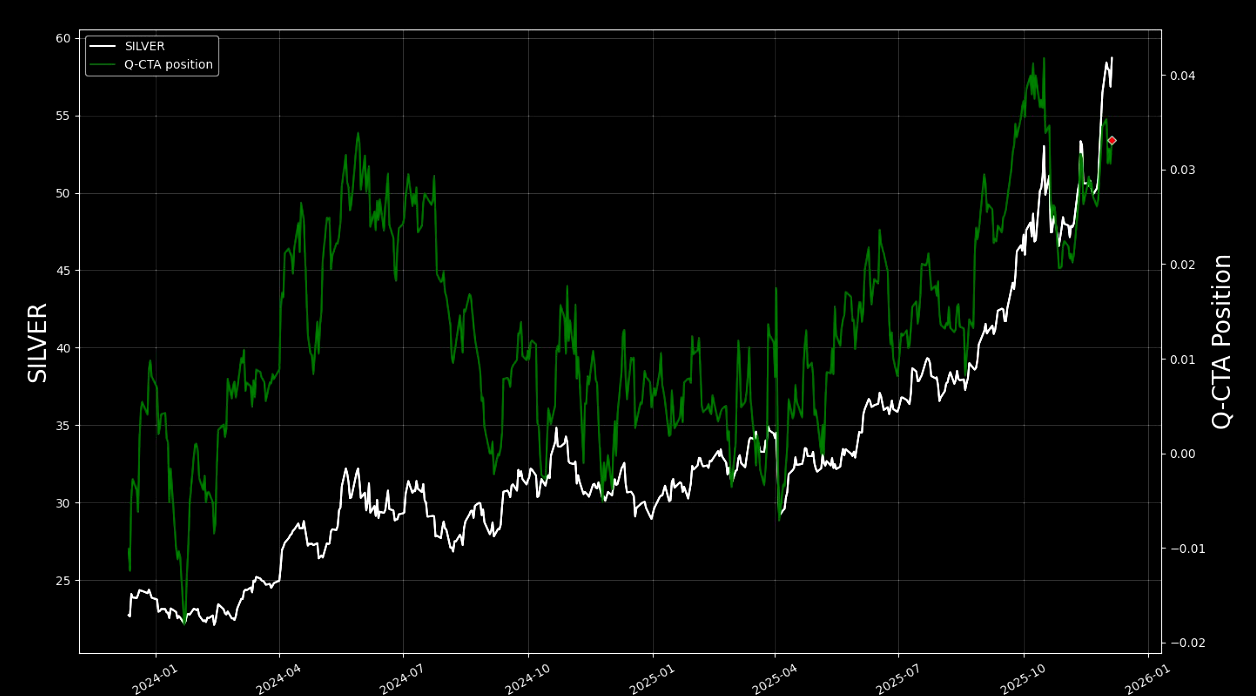

Momentum chasers

CTAs in full silver chase mode... but positioning is still not at extremes.

Source: MentorQ

Chasing ETFs

Silver ETF holdings on the rise again...

Source: ING

Precious vs tech

"Today, there is about $32.5T invested in the Nasdaq 100, up from $12.5T three years ago today. A year ago, $300B was invested in precious metals; now > $600B. A small amount of capital migrating into hard assets carries a HIGH impact." (Lawrence McDonald, Bear Traps)

The AI connection

Nothing new, but a gentle reminder....you need silver to run all those AI machines...

Source: LSEG Workspace

Silver miners

Silver miners below ATHs, but still beating silver by miles. Note the latest little "catch up" by silver.

Source: LSEG Workspace

Fundamentals

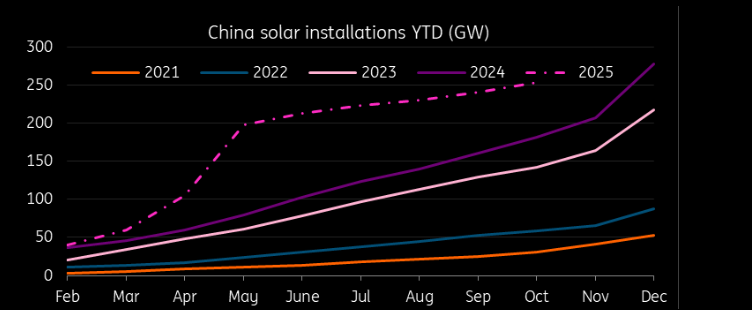

Silver’s outlook is more tied to industrial demand, which makes up over half of its use. While solar demand may cool after peaking in 2025, silver should still benefit from electrification trends, grid upgrades, and increased use in hybrid and EV components.

Source: ING

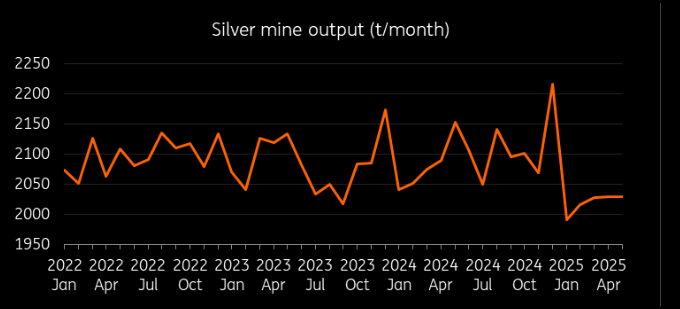

Silver supply

Silver is set for a fifth straight year of supply deficits, with output structurally inelastic since 70–80% comes as a by-product of other metals. Mined production is down ~3%, constrained by lower ore grades and a lack of new projects.

via zer0hedge

No comments:

Post a Comment