Futures Drop As Silver Slides From Record

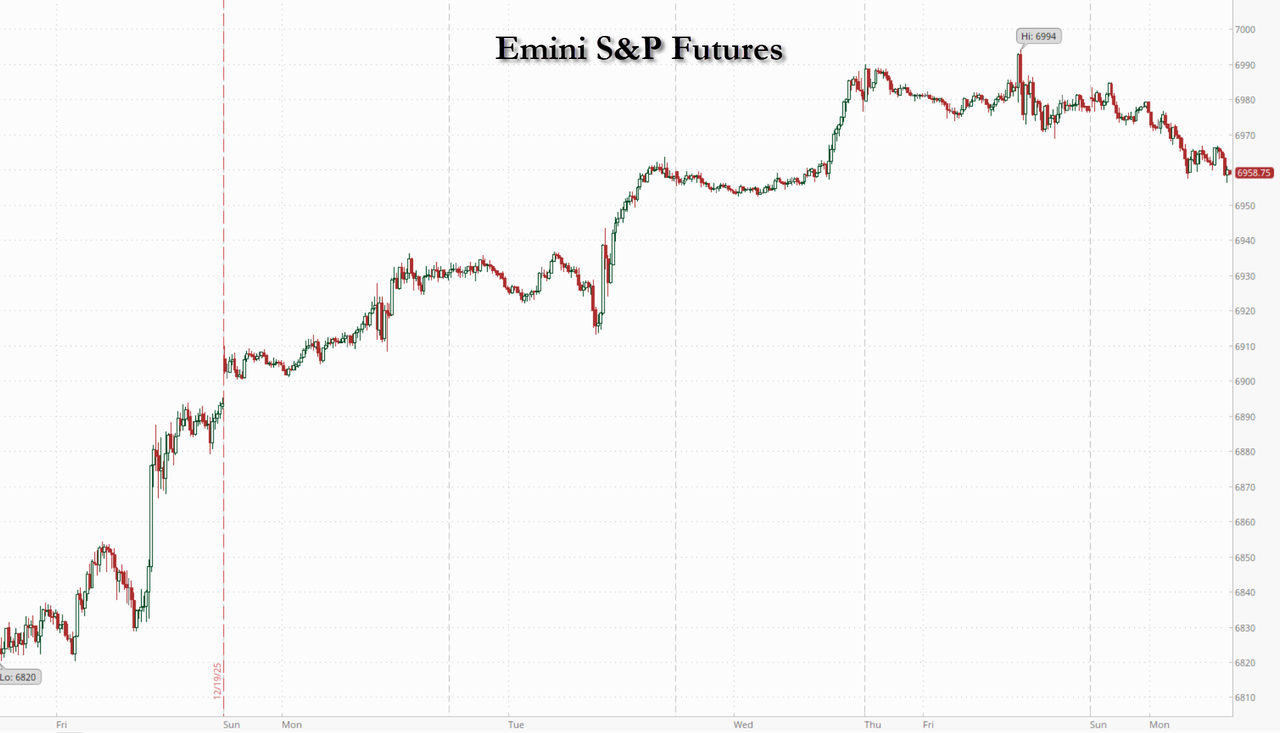

Stocks are extending their modest losses from their pre-Christmas record as another shortened trading week starts. As late last week, much of the market action is in precious metals, with silver first smashing through $80 for the first time before sliding while gold also retreated from Friday’s all-time high and platinum pulling back sharply after surging nearly 10%, and hitting limit down in China along with Platinum.As of 8:15am, S&P 500 futures were 0.3% lower while Nasdaq 100 contracts were down 0.4% as Tesla and Nvidia slid more than 1% to lead premarket losses among Mag 7. Europe’s Stoxx 600 was little changed following talks about a peace deal for Ukraine that yielded no breakthrough. Treasuries gained with 10Y yields down 0.2bps from Friday's close to 4.11% while the BBG dollar index rose. Bitcoin briefly surged back over $90,000 before getting summarily slammed right back down. Trading is likely to be light again, accompanied by a threadbare economic calendar and the absence of major planned corporate events.

In premarket trading, Tesla and Nvidia underperform Mag 7, putting pressure on US stock futures (Tesla -1%, Nvidia -1%, Alphabet -0.5%, Meta -0.4%, Apple -0.2%, Microsoft -0.1%, Amazon +0.1%)

- Silver stocks including Coeur (CDE) and Hecla (HL) fall as the precious metal retreated sharply after smashing through $80 an ounce for the first time. Coeur -4.5%, Hecla -4%

- Coupang (CPNG) gains 2% after offering compensation worth more than $1 billion to all customers affected by South Korea’s biggest-ever data breach.

- DigitalBridge Group (DBRG) soars 33% as SoftBank Group is said to be in advanced talks to acquire the private equity firm that invests in assets such as data centers.

- Energy Fuels (UUUU) gains 3% after saying it exceeded 2025 uranium production and sales guidance.

- Lululemon Athletica Inc. (LULU) rises 0.9% after the WSJ reported that founder Chip Wilson is launching a proxy fight at the retailer.

In corporate news, Japan’s SoftBank is in advanced talks to acquire DigitalBridge Group, a private equity firm that invests in assets such as data centers, according to people with knowledge of the matter.

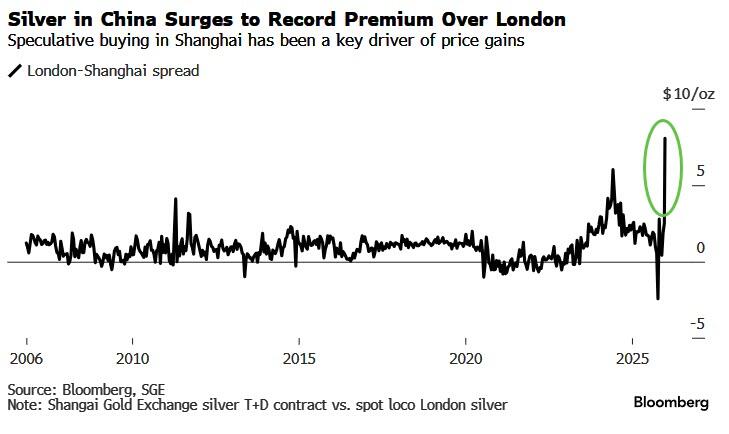

With stock trading rather subdued, precious-metal price swings remained the overnight highlight, with silver spiking as much as 6% on Monday, before profit takers stepped in to send it back below Friday’s close. As a result, silver retreated sharply after smashing through $80 an ounce for the first time, halting a record-breaking rally powered by Chinese speculative demand.

The white metal fell by more than 6% as it took a roller-coaster ride Monday after earlier hitting $84 an ounce. Surging Chinese investment demand has pulled the metal higher, with premiums for spot silver in Shanghai rising above $8 an ounce over London prices, the biggest spread on record. Elon Musk fed the early momentum with his reply to a tweet about Chinese export restrictions due to start on Thursday, saying on X over the weekend: “This is not good. Silver is needed in many industrial processes.”

Silver, which had risen more than 40% since the start of the month through Friday, has been spurred like other precious metals this year by elevated central-bank purchases, inflows to exchange-traded funds and three rate cuts by the Fed. Lower borrowing costs burnish the attraction of commodities and traders are betting on more rate cuts in 2026. Frictions in Venezuela and strikes by Washington on Islamic State targets in Nigeria have also added to the haven appeal of metals. With silver inventories near their lowest on record, there’s a risk of supply shortages that could impact multiple sectors.

Bank of America CEO Brian Moynihan said he expects the Trump administration to de-escalate trade tensions next year after tariffs sent shockwaves through the US economy in 2025. He said in an interview aired Sunday on CBS News that BofA now sees “de-escalation, not escalation,” with an average of 15% tariffs and higher rates for countries that won’t commit to US purchases or lowering non-tariff barriers.

Despite the market closing out 2025 at an all time high, tariffs and other curve balls made it a brutal year for stock pickers. About $1 trillion was pulled from active equity mutual funds over the year, according to estimates from Bloomberg Intelligence using ICI data, marking an 11th year of net outflows and, by some measures, the steepest of the cycle. By contrast, passive equity exchange-traded funds got more than $600 billion.

“The question of ‘is AI a bubble’ will remain front and center for investors in 2026,” wrote Richard Flax, chief investment officer at Moneyfarm. “The scale of current investment and the pace of innovation mean that even the sceptics cannot ignore its influence on both markets and the real economy.

In geopolitical news, President Donald Trump said he made “a lot of progress” in talks with Ukrainian President Volodymyr Zelenskiy over a possible peace deal, but that it might take a few weeks to get it done.

Europe’s Stoxx 600 was little changed following talks about a peace deal for Ukraine that yielded no breakthrough. Miners outperform, driven by surging metals prices, while industrial goods and services stocks are among the biggest laggards. Here are some of the biggest movers on Monday:

- Fresnillo shares climb as much as 5.3% on Monday to the highest level on record, leading a rally in mining stocks driven by surging metals prices.

- International Personal Finance rises as much as 6.8% in London trading after Basepoint agreed to buy the consumer finance company in a deal valuing IPF at about £543 million.

- BioGaia shares gain as much as 4.2% as DNB Carnegie lifts its price target on the Swedish probiotics firm and says the stock may break out on the upside from its five-year trading range in 2026 as margins improve.

- Bonesupport shares advance as much as 4.5% on Monday as DNB Carnegie repeats its positive stance on the Swedish medical equipment firm and says valuation seems attractive given potential for growth.

- Leonardo shares fall as much as 4.7% after US President Donald Trump said he made “a lot of progress” in talks with Ukrainian President Volodymyr Zelenskiy over a possible peace deal.

Earlier in the session, Asian equities extended gains for a seventh day, the longest winning streak in three months, buoyed by advances in tech firms. The MSCI Asia Pacific Index climbed as much as 0.6%, boosted by TSMC, SK Hynix and Samsung Electronics. South Korea led gains in the region, while benchmarks in Taiwan and Tokyo also rose. China’s markets reversed earlier gains despite Beijing’s pledge to broaden its fiscal spending base in 2026. Meanwhile, mining shares across Asia climbed after silver rallied to a new peak, before sliding.

Elsewhere in commodities, copper, fueled by concerns over tighter supply, pushed hard toward $13,000 a ton, setting a fresh record on the London Metal Exchange. Oil also rose as the US-led talks failed to yield a breakthrough and as China vowed to support economic growth next year. Brent crude is still on track for a fifth monthly drop in December, which would be the longest losing streak in more than two years.

Bitcoin topped $90,000 before erasing the gain. A gauge of the dollar was steady. US Treasuries strengthened across the curve, with the 10-year yield falling one basis point to 4.12%.

In rates, treasuries hold small gains on lower-than-average futures volumes to begin the year’s final week, amid similar price action in most European bond markets where trading resumed after Friday’s holiday. Yields are lower by about 1bp-2bp across tenors with the curve slightly flatter; 10-year declined as much as 2.5bp to 4.10%, lowest level since Dec. 18. Treasuries remain headed for a small monthly loss amid signs of US economic resilience, yet still on pace for their best annual performance since 2020 following three Fed interest-rate cuts in response to weakening labor-market conditions

The US economic data calendar includes November pending home sales (10am) and December Dallas Fed manufacturing activity (10:30am); no Fed speakers are scheduled until Jan. 3

Market Snapshot

- S&P 500 mini -0.3%,

- Nasdaq 100 mini -0.4%,

- Russell 2000 mini little changed

- Stoxx Europe 600 little changed,

- DAX -0.2%,

- CAC 40 little changed

- 10-year Treasury yield -2 basis points at 4.11%

- VIX +1.2 points at 14.82

- Bloomberg Dollar Index little changed at 1200.67,

- euro little changed at $1.1777

- WTI crude +2% at $57.89/barrel

Top Overnight News

- Ukraine Seeks 50-Year U.S. Security Guarantee, Trump Offers 15: WSJ

- China stages record drills designed to encircle Taiwan: RTRS

- Chinese Military Drills Send ‘Stern Warning’ After U.S. Arms Sales to Taiwan: WSJ

- Why a Chinese Attack on Taiwan Would Be Japan’s Problem: WSJ

- China Swipes at Trump in Move to Be Thai-Cambodia Peacemaker: BBG

- Netanyahu Meets Trump as Gaza Ceasefire Approaches Crossroad: BBG

- US pledges $2 billion in humanitarian support to UN, State Department says : RTRS

- Justice Department Using Fraud Law to Target Companies on DEI: WSJ

- Every Wall Street Analyst Now Predicts a Stock Rally in 2026: BBG

- Xi’s Triumphant Year Staring Down Trump Belies Woes in China: BBG

- Lululemon Founder Launches Proxy Fight to Change Board: WSJ

- Copper Rallies to Record Near $13,000 in London on Supply Fears: BBG

- Ph.D.s Can’t Find Work as Boston’s Biotech Engine Sputters: WSJ

- Publicly Traded Private-Credit Funds Set for Worst Year Since 2020: BBG

- Canada Pensions Overseeing $1.2 Trillion Revamp Private Equity Model: BBG

- SoftBank Nears Deal for Data Center Investment Firm DigitalBridge: BBG

- How a Reclusive Ex-Glencore Trader Became Indonesia’s Nickel King: BBG

US Event Calendar

- 10:00 am: Nov Pending Home Sales MoM, est. 0.96%, prior 1.9%

- 10:30 am: Dec Dallas Fed Manf. Activity, est. -6, prior -10.4

- via zer0hedge

No comments:

Post a Comment